Southern Peripheral Road (SPR) in Gurugram is one of the fastest-rising residential corridors in the Delhi–NCR. By 2025 the road has attracted established developers and new launches, combining strong connectivity to corporate hubs and the airport with large integrated projects and premium low-rise options. Below is a practical, fact-based guide to the top 10 SPR residential projects you should know before investing — each entry covers price ranges, typical sizes, key amenities, project land area where available, and the location advantages that make SPR projects attractive. Sources are listed inline for the most important facts.

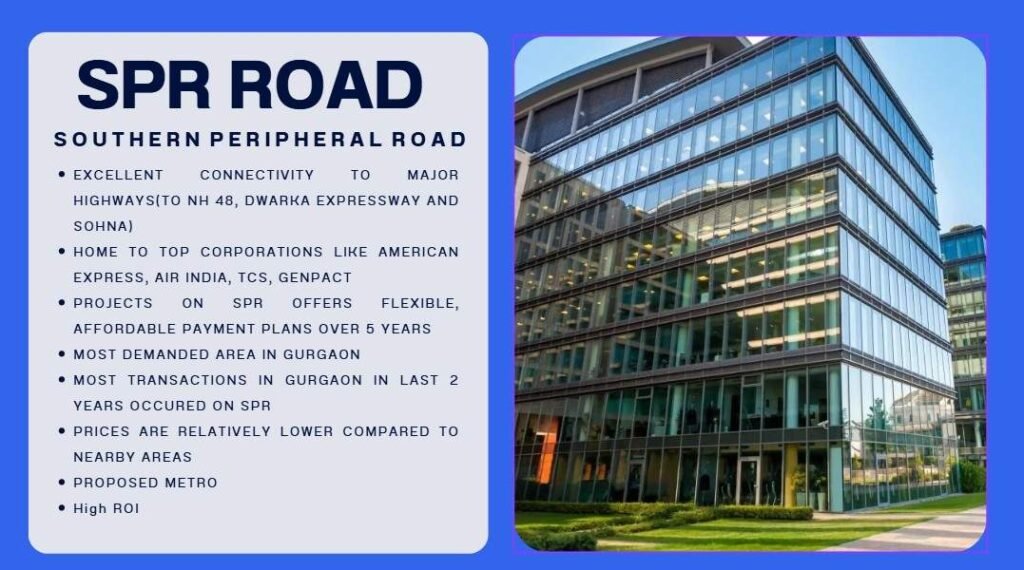

Why SPR Road is a smart place to invest in 2025

SPR (Southern Peripheral Road) runs across Gurugram and links key highways and city corridors. The road improves access to Golf Course Road, Golf Course Extension Road, Sohna Road, NH-8 and reduces travel time to the Indira Gandhi International (IGI) Airport. Planned upgrades and recent real-estate demand on SPR make it a preferred corridor for families and investors seeking long-term appreciation and rental demand from corporates nearby.

Key advantages:

- Direct and quick link to corporate clusters on Golf Course Road and the Cyber hubs of Gurugram.

- Better airport connection compared to many inner-city pockets.

- New social infrastructure (schools, hospitals, retail) being added along SPR.

- Mix of low-rise luxury floors and high-rise premium apartments, giving buyers choice between independent-like homes and tower conveniences.

Top 10 SPR Projects — quick comparison (price, typical size, land area)

Below is a fact-based comparison table (price, typical unit sizes, and reported land / project area) for the projects you listed. Figures are indicative (developer / portal sources and listing pages cited). Always confirm exact current price/availability with the developer or an authorised broker before transacting.

| Project | Indicative price (starting / typical) | Typical unit size (sq.ft) | Reported land / project area |

| Tulip Melrose — Sector 70 | ≈ ₹4.65 Cr (approx — based on ~₹13,750/sq.ft for a 3,216 sq.ft 5-BHK example). | 3,216 sq.ft (5-BHK single layout quoted). | ~7.5–7.85 acres (developer/marketing pages). |

| Tulip Crimson — Sector 70 | ~₹4.80 Cr (example listing); prices vary by unit/phase — verify current price list. | Super built-up example: 3,090 sq.ft (4-BHK layouts noted). | ~9.16 acres (project info on portals). |

| Birla Pravaah — Sector 71 | Starting ~₹3.3 Cr (developer listing indicates ~₹3.3 Cr start for larger 3BHK/3.5BHK units). | Typical sizes ~2,000–2,450 sq.ft (3 / 4-BHK layouts). | Multi-acre planned campus (developer portal lists as a multi-acre development). |

| Trehan Luxury Floors (near SPR) | Example/typical builder-floor listing: ₹1.85 Cr for ~1,760 sq.ft (varies by sector/phase). Market ₹/sq.ft also shown ≈₹12.6k/sq.ft (portal averages). | Typical 3BHK builder floor examples ~1,600–2,900 sq.ft (depends on build & terraces). | Small / low-density footprints per project (varies by scheme) — usually not mega-acre towers (project-level only). |

| Signature Global — Cloverdale SPR (Sector 71) | Pricing shown on portals as ~₹19k–21k per sq.ft (~workout prices depending on unit); typical large-unit totals commonly in multiple crores. | Typical sizes listed ~2,095 sq.ft (3BHK) up to ~3,480 sq.ft (4.5BHK) in marketing. | ~8.12 acres (portal / project listing). |

| Signature Global — Titanium SPR (Sector 71) | Examples: 3.5BHK from ~₹5.28 Cr; 4.5BHK ~₹6.8 Cr (portal listing examples). | Typical sizes cited ~2,780 sq.ft (3.5BHK) to ~3,780 sq.ft (4.5BHK). | Project area varies by phase; developer pages list large masterplan and multiple towers (confirm phase). |

| M3M Golf Hills — Sector 79 | 4-BHK examples ~₹4.9–5.06 Cr (portal listings). Avg price per sqft shown on portals ~₹14–15k/sq.ft depending on phase. | Typical sizes: ~1,420–2,685 sq.ft (super built-up ranges across configurations). | ~54 acres (project area reported on portals; large integrated project). |

| M3M Antalya Hills — Sector 79 | Typical prices ~₹1.71–1.86 Cr for smaller units (portal listing); per sq.ft figures ~₹13.5–14.75k/sq.ft. | Typical sizes ~1,138–1,534 sq.ft (super built-up ranges). | ~24.2 acres (project area reported). |

| Conscient Elaira Residences — Sector 80 | Starting / typical prices reported ~₹2.69–3.15 Cr (portal / developer excerpts). | Typical sizes shown ~1,396–1,932 sq.ft (3-BHK variants); other pages list 1,995–2,800 sq.ft for some units — check phase/floorplan. | ~4.87–5.5 acres (portal & project pages report ~4.9–5.5 acres). |

| Sobha Aranya — Sector 80 | Price examples per portals: ₹6.6–7.45 Cr (portals) / other marketing shows from ~₹7.10 Cr onwards for 3BHK+ sizes. | Typical sizes ~2,836–3,691 sq.ft (3 & 4 BHK configurations on portals). | ~31.28 acres (project/phase area reported in township context). |

| DLF Privana North (North) — Sector 76/77 | Starting/typical prices widely reported in the high-end segment: examples ₹8.5–10.0 Cr onwards (DLF listing and market reports). | Typical 4-BHK examples cited ~2,236 sq.ft (some listings) up to 3,500–4,000+ sq.ft for larger layouts/penthouses in various reports. | ~17.7–18 acres (DLF project pages / portals). |

Why SPR

SPR (Southern Peripheral Road) is now one of Gurgaon’s fastest-developing residential corridors. Projects on SPR combine easier access to the city’s corporate hubs and improved airport connectivity, and many developers are launching large integrated projects here. For example, M3M Golf Hills and M3M Antalya Hills are large integrated townships (reported 54 acres and 24.2 acres respectively), while DLF Privana North and Tulip developments are positioned as premium / ultra-luxury offerings.

Why investors look at these SPR projects:

- Corporate proximity & rental demand — SPR shortens commutes to major corporate clusters and business parks, improving rental appeal for executives working on Golf Course Road, Cyber hubs and newer SEZs. (See project pages where developers highlight corporate connectivity.

- Better airport access — SPR offers quicker links toward NH-8 and the IGI airport corridor compared with many inner sectors, which many project pages and marketing materials highlight.

- Product mix — SPR has both low-rise luxury floors (Trehan, builder-floor products) and large gated high-end towers (DLF, Signature, M3M, Tulip). This gives buyers options by budget, family size and ownership style.

FAQs

1. Why is SPR Road Gurgaon considered the next investment hotspot?

Southern Peripheral Road (SPR) connects Golf Course Road Extension, Sohna Road, NH-48, and Dwarka Expressway. This makes it one of the most strategic corridors for both residential and commercial growth. The road provides smoother access to corporate hubs like Cyber City, Golf Course Road, and Udyog Vihar, while still offering better space utilization and newer infrastructure. As metro and flyover upgrades complete, SPR property values are expected to appreciate further.

2. Which project on SPR is best for luxury family living?

For families seeking ultra-luxury homes, Tulip Melrose and Tulip Crimson Residences in Sector 70 offer large layouts (up to 3,000 sq.ft), premium amenities, and excellent proximity to schools and hospitals. DLF Privana North also stands out for its brand reliability, high-end finishes, and open green land area. These projects provide low-density living with gated security and world-class clubhouse facilities.

3. Which projects on SPR offer the best price appreciation potential?

Projects in Sector 70–71 like Birla Pravaah, Signature Global Cloverdale, and Signature Global Titanium are at the heart of SPR. These sectors benefit from ongoing infrastructure growth, metro connectivity, and closeness to Golf Course Extension Road. As the corridor matures, these mid-premium projects are expected to see strong appreciation between 2025–2030 due to balanced pricing and high demand from working professionals.

4. Are there any good low-rise or independent floor options on SPR?

Yes. Trehan Luxury Floors are among the top low-rise options along SPR Road. They combine the privacy of independent living with the security and amenities of gated communities. The floors are Vastu-compliant, offer private parking, and often come with terrace or basement options. Such floors are highly preferred by families seeking peaceful living in Gurgaon’s prime sectors without the high maintenance of large towers.

5. Which projects offer the best connectivity to IGI Airport?

Almost all projects along SPR Road have quick access to NH-48, which directly leads to Indira Gandhi International Airport in around 25–30 minutes. M3M Golf Hills, M3M Antalya Hills, and Conscient Elaira Residences in the Sector 79–80 region offer smooth connectivity via the upcoming cloverleaf junction and Dwarka Expressway link. For frequent flyers and corporate executives, this location advantage is a major draw.

6. Which project has the largest land area on SPR Road?

Among the listed projects, M3M Golf Hills stands out with approximately 54 acres of land — making it one of the largest integrated residential developments in Gurugram. This vast area allows for more green spaces, better amenities, and lower population density per acre. Sobha Aranya (around 31 acres) and DLF Privana North (around 18 acres) also rank high in terms of land parcel size and overall planning.

7. Are these projects RERA registered and safe to invest in?

Yes, all top developers mentioned — including Tulip Infratech, Birla Estates, Trehan Developers, Signature Global, M3M India, Conscient, Sobha, and DLF — are RERA-registered and have a strong reputation in the market. Always verify the RERA number on the Haryana RERA portal (haryanarera.gov.in) before booking, and cross-check project delivery timelines for added assurance.

8. What makes SPR projects ideal for rental income?

The SPR corridor is surrounded by IT parks, SEZs, and commercial centres such as M3M Urbana, AIPL Joy Street, and upcoming corporate parks near Sector 71–75. This attracts a steady flow of professionals seeking high-quality rentals. Projects like Birla Pravaah, Signature Cloverdale, and M3M Antalya Hills are especially attractive to tenants due to modern amenities, security, and proximity to office hubs. Average rental yields in the area are typically 3–4% annually, with potential for long-term appreciation.